[最も欲しかった] gift funds freddie mac 171400-Does freddie mac allow gift funds

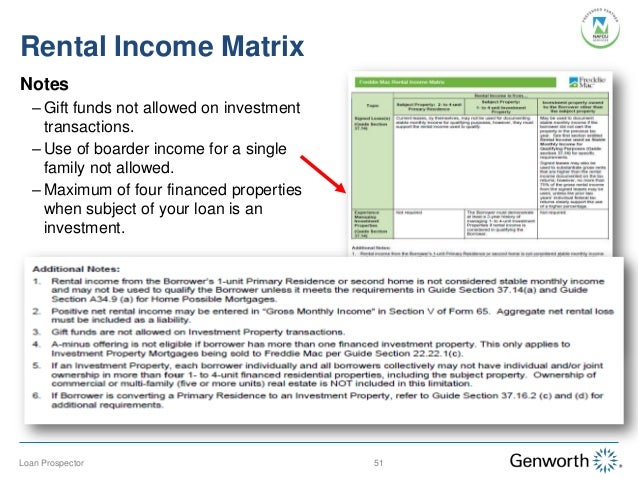

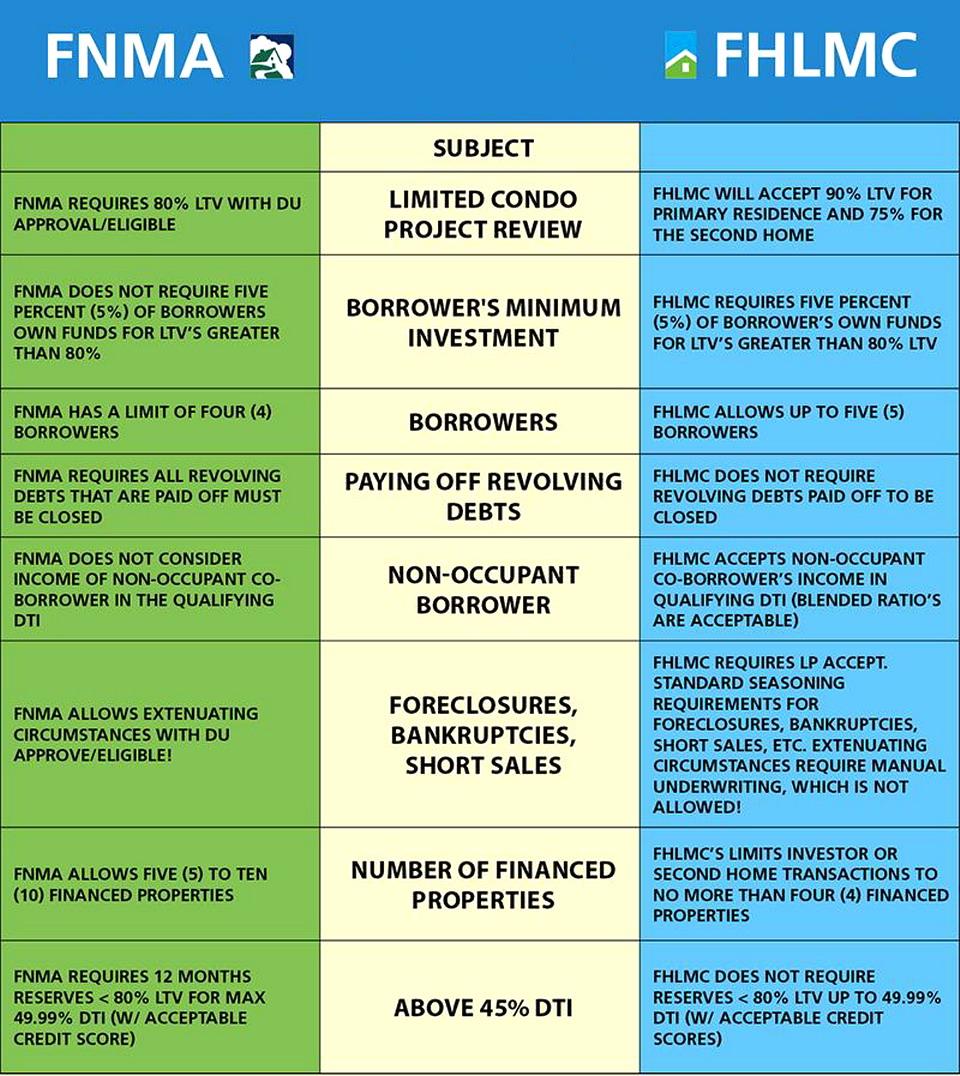

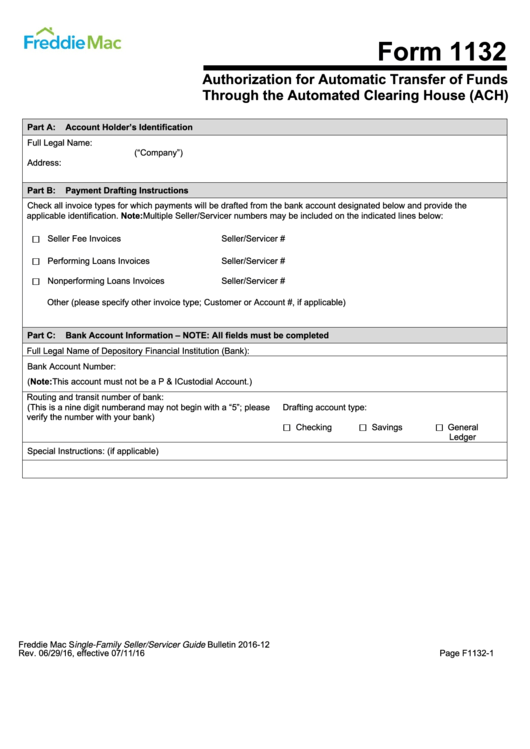

Gift funds for Freddie Mac can only be used when financing a primary residence or second (vacation) home Gifts may not be used when financing an investment property When using gift funds for a second home the loantovalue must be 80% or less with at least 5% of the down payment coming directly from the borrower (can not be gifted)3500 Freddie Mac Servicer Success Performance and File Reviews 3600 Remedies (Including Repurchase and Termination of Servicing) CLOSE Selling This segment includes requirements applicable to originating, underwriting, and selling eligible Mortgages (Series 4000 through 6000) Browse Selling 4000 Announcement 051 Conforming Freddie Mac Updates Gift Funds Effective immediately, Freddie Mac has updated their guidelines when gift funds are used When gift funds are used the borrower must provide either Evidence of transfer of funds from the donor's account in a financial institution to the borrower's account For example, copies of bank statements from

The Ins And Outs Of Giving Or Receiving Down Payment Gifts Elite Realty Brokerage

Does freddie mac allow gift funds

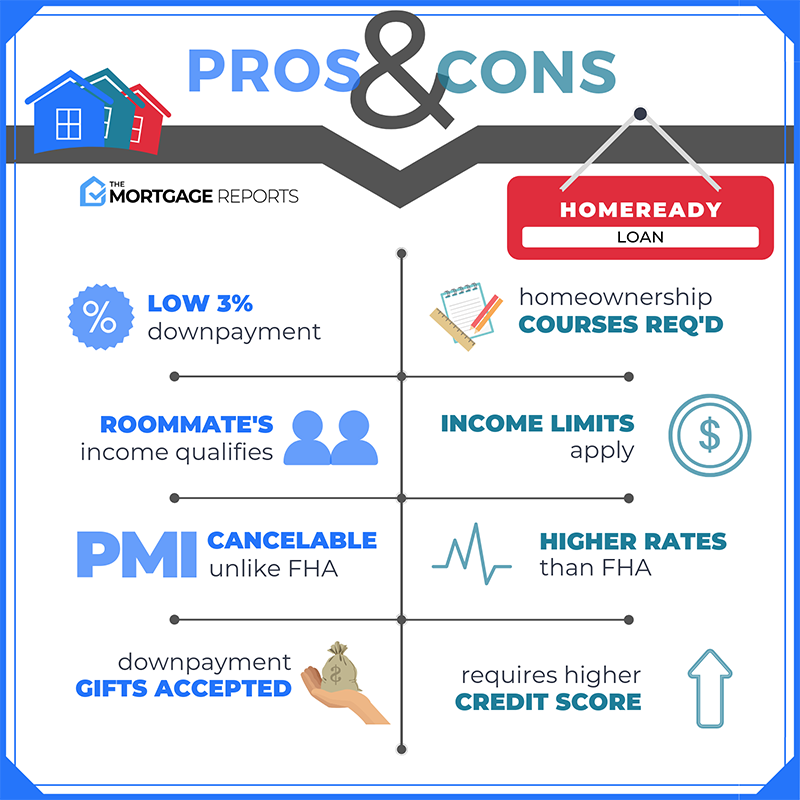

Does freddie mac allow gift funds- Fannie Mae and Freddie Mac loans with a down payment gift of percent or more do not require a minimum borrower contribution Borrowers must contribute at least 5 percent to their down payment, Gift funds are not allowed for investment properties;

Http Www Wshfc Org Sf Hpaforhfasjuly19washingtonstatefhlmc Pdf

Freddie Mac will consider gift and grant programs for eligibility on a negotiated basis We want to hear about existing gift and grant programs to help shape the details of these negotiated terms and the effective date of the policy change, which will be announced in a future 16 Bulletin This change does not apply to down payment programs from nonprofit or government agenciesUsing Gifts with Conventional Financing Conventional loans backed by Fannie Mae and Freddie Mac allow the borrower to apply financial gifts to the down payment, fees, and closing costs The borrower usually does not need their own funds when receiving a gift if the gift covers the entire down payment and other loan costsThis buyer's cash requirement was reduced from $9,000 to just $1,500 thanks to flexibilities with the Home Possible mortgage offering combined with Freddie Mac BorrowSmart Check your AMI and high needs area eligibility If you're like most

• Gift funds are allowed in accordance with Freddie Mac guidelines • Except as stated below, the Seller is not required to document the sources of unverified deposits for purchase or refinance transactions However, when qualifying the Borrower, the Lender must consider any liabilities resulting from all borrowed funds For purchase transactions, the Seller must document the source of fundsThey are allowed for primary residences and second homes;• fiancé or fiancée or domestic partner Note Unrelated persons are eligible donors of wedding gifts

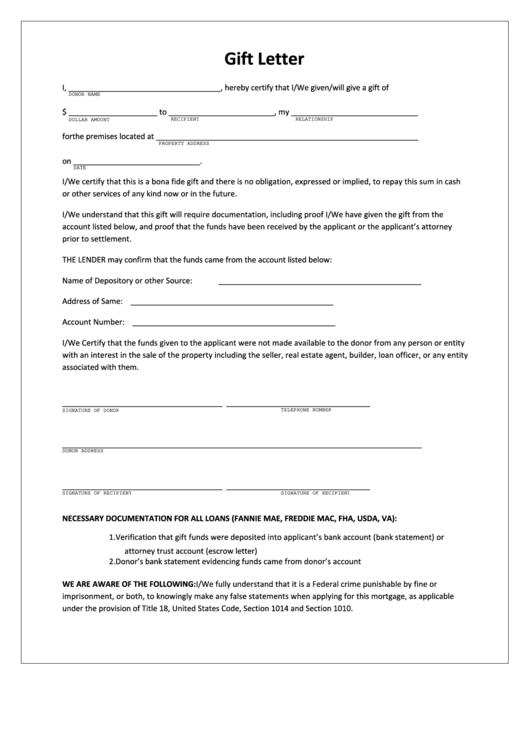

Gift funds may be used to pay off collection, chargeoffs, judgments, garnishments and/or liens Freddie Mac LP already been deposit in a liquid asset account Gifts are eligible on purchase and refinance transactions of primary residences and second homes only A gift must be from a related person that does not have to be repaid Freddie Mac LPA related person is any of the following Freddie Mac is extending the right of first refusal time period requirements not to exceed 1 days (From 90 days) Wedding Gifts Wedding gift funds are an eligible source of funds for a primary residence when the gift funds were deposited in the borrower's account within 90 days (previously 60 days) of the date of the marriage license or certificateFreddie Mac Gift Letter Form freddie mac prices 7 million multifamily k deal k 1511, 15 40 fhlmc bulletin 15 12 various changes pcg, fannie mae or freddie mac harp refinance guidelines for, using gift funds for a down payment atlantic bay mortgage, employer gifts grants national association of mortgage, employer gifts grants national association of mortgage, the rules for

Conventional Mortgage 5 Down Payment 100 From Gift Funds

Mortgage Down Payment Gift Rules What You Should Know

Cash from buyer $1,500; For Sellers that have obtained Freddie Mac's prior written approval, persons and/or Related Persons were an eligible source of funds for a Mortgage secured by a Primary Residence if the gift funds were on deposit in the Borrower's depository account within 60 days of the date of the marriage license or certificate We are extending the allowable time frame for the gift fundsEffective immediately, Freddie Mac will now allow a gift donor to pay the Borrower's earnest money deposit (EMD) directly to the builder or real estate agent if evidence is provided for the transfer of the funds from the donor's account in a financial institution to the earnest money deposit holder Freddie Mac's current guides require that in all instances gift funds be transferred

Weddings And Home Loans Using Gift Funds For A Down Payment

100 Gift Funds As The Down Payment For Your New Home

Answer Freddie Mac does not restrict or govern where the donor gets their funds See excerpt below from Freddie selling guide (and highlighted text) Reference Asset eligibility and A subscription is required to Effective immediately, Freddie Mac has updated their guidelines when gift funds are used When gift funds are used the borrower must provide either Evidence of transfer of funds from the donor's account in a financial institution to the borrower's account For example, copies of bank statements from both the donor and the borrower's accounts, or a copy of a canceled giftFreddie mac gift funds guidelines Top Looking for money for a down payment is often the hardest part of buying a house Some people buy scrimp and save to get cash while others dip into their retirement accounts It is also common for potential buyers to receive some or all of their down payments as a gift Lenders accept gift money from borrowers but follow certain rules and

Commentary Fannie Mae Freddie Mac Offer Mortgages For 3 Percent Down Ws Chronicle

Http Www Wshfc Org Sf Hpaforhfasjuly19washingtonstatefhlmc Pdf

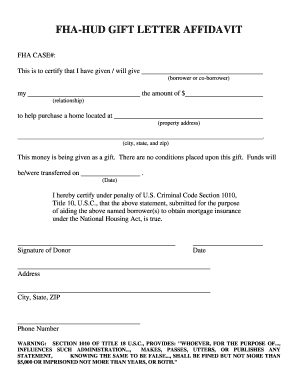

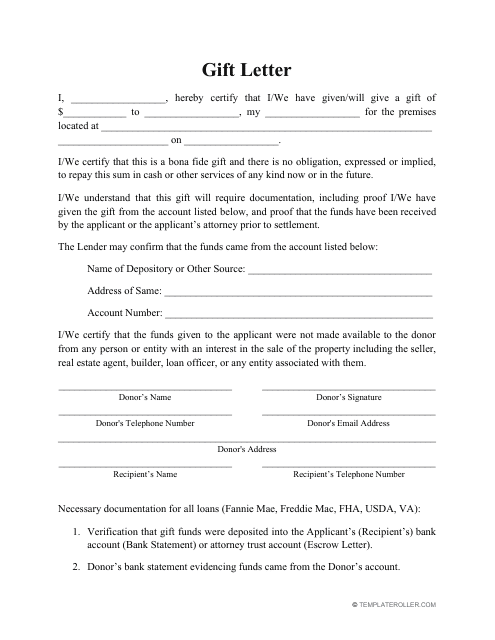

Grossing up income, optional follow Fannie Mae, Freddie Mac, FHA, VA, or RD guidelines Lender performs credit underwriting;Gift Funds and Gifts of Equity – All Agencies – Chart Answer Both agencies allow gift of equity as the source of down payment for a HomeReady or Home Possible mortgage A lender can choose to overlay that ability, but Fannie and Freddie do not prohibit when the donor is an eligible donorGift funds received as a wedding gift from unrelated persons and/or Related Persons is an eligible source of funds for a Mortgage secured by Primary Residence The gift funds must be on deposit in the Borrower's depository account within 60 days of the date of the marriage license or certificate Provide the following A copy of the marriage license or certificate A verification of the gift funds

Atlas Mortgage Atlas Mortgage Twitter

Www Mgic Com Media Mi Underwriting 71 Summary Pdf Puerto Rico Uw Pdf

Borrower of a mortgage loan secured by a principal residence or second home may use funds received as a personal gift from an acceptable donor Gift funds may fund all or part of the down payment, closing costs, or financial reserves subject to the minimum borrower contribution requirements below Gifts are not allowed on an investment propertyIn addition to gift funds, FHA and Freddie Mac offer other down payment options FHA's Cash Down Payment In addition to gift funds, FHA allows the use of cash you've saved outside of any banking or investment institution While most lenders will not accept this type of cash, with the accompaniment of a letter of explanation, FHA will allow cash to be used for your down paymentOtherwise, refer to the respective Agency selling guide for requirements not provided in the Findings/Feedback We do not approve loans for mortgage insurance based solely on a response obtained from Agency automated underwriting systems, Fannie Mae's Desktop

Down Payment Gift Rules From A Friend Or Relative

Http Www Wshfc Org Sf Hpaforhfasjuly19washingtonstatefhlmc Pdf

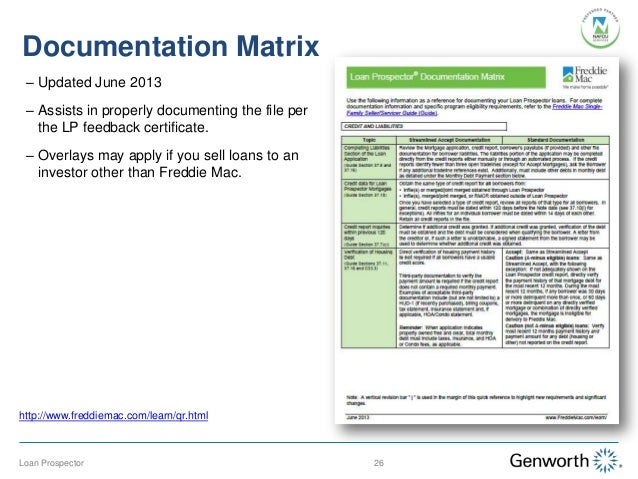

These guidelines apply If it's a singlefamily home, you can use gift funds without having to contribute any of your own money to your down payment If it's a multifamily home, you can get a home without having to contribute to the down payment as long as the down payment is % or more If your down payment is % or less on a multiunitHOA dues must meet IPC limits See Freddie Mac's Seller's Guide – Section 253 for additional details Gifts Including Gift of Equity Occupancy Type < 80% LTV,TLTV,HTLTV >80% LTV,TLTV,HTLTV Primary Residence None, all funds ok to gift None, all funds ok to gift Second Home None, all funds ok to gift 5% Min Borrower Contribution May 21 Freddie Mac Learning Use the following information as a reference for documenting your Loan Product Advisor loans For complete documentation information and specific program eligibility requirements, refer to the Freddie Mac SingleFamily Seller/Servicer Guide (Guide) We recommend bookmarking the Guide link (https//guidefreddiemac

Zemuuntgbxm6pm

Www Plazahomemortgage Com Downloadfile Aspx Filepath Documents Plazaprograms Freddie mac retained conforming fixed program guidelines gd Pgco 016 Pdf Filename Freddie mac retained conforming fixed program guidelines gd Pgco 016 Pdf

Agency Eligible Donors Personal Gift Funds and Gift of Equity Guidelines Freddie Mac Selling Guide a related person, defined as the borrower's spouse, child, or other dependent, or any individual who is related to the borrower by blood, marriage, adoption, or legal guardianship; makeup gift ideas pinterest Payless Shoes Gift Card Balance Canada It could well be that other networks can beat Sky's pricing, even with your inclusive discount for being a Sky freddie mac gift funds requirements TV customers Ikon pass promo code 19 Grove city outlet mall printable o2 trainer promo code coupons With most songs lastingConventional loans For a conventional loan through Fannie Mae or Freddie Mac, the gift must come from family (by blood, marriage, adoption, or legal guardianship) Fiancés and domestic partners also count as family FHA loans FHA loans define family slightly differently Cousins, nieces, and nephews don't count under normal family guidelines, but they do allow gifts from

Fannie And Freddie Face Price Competition From Mortgage Investors Orange County Register

4 Mortgage Programs That Will Convert Renters Into Buyers Real Estate Marketing

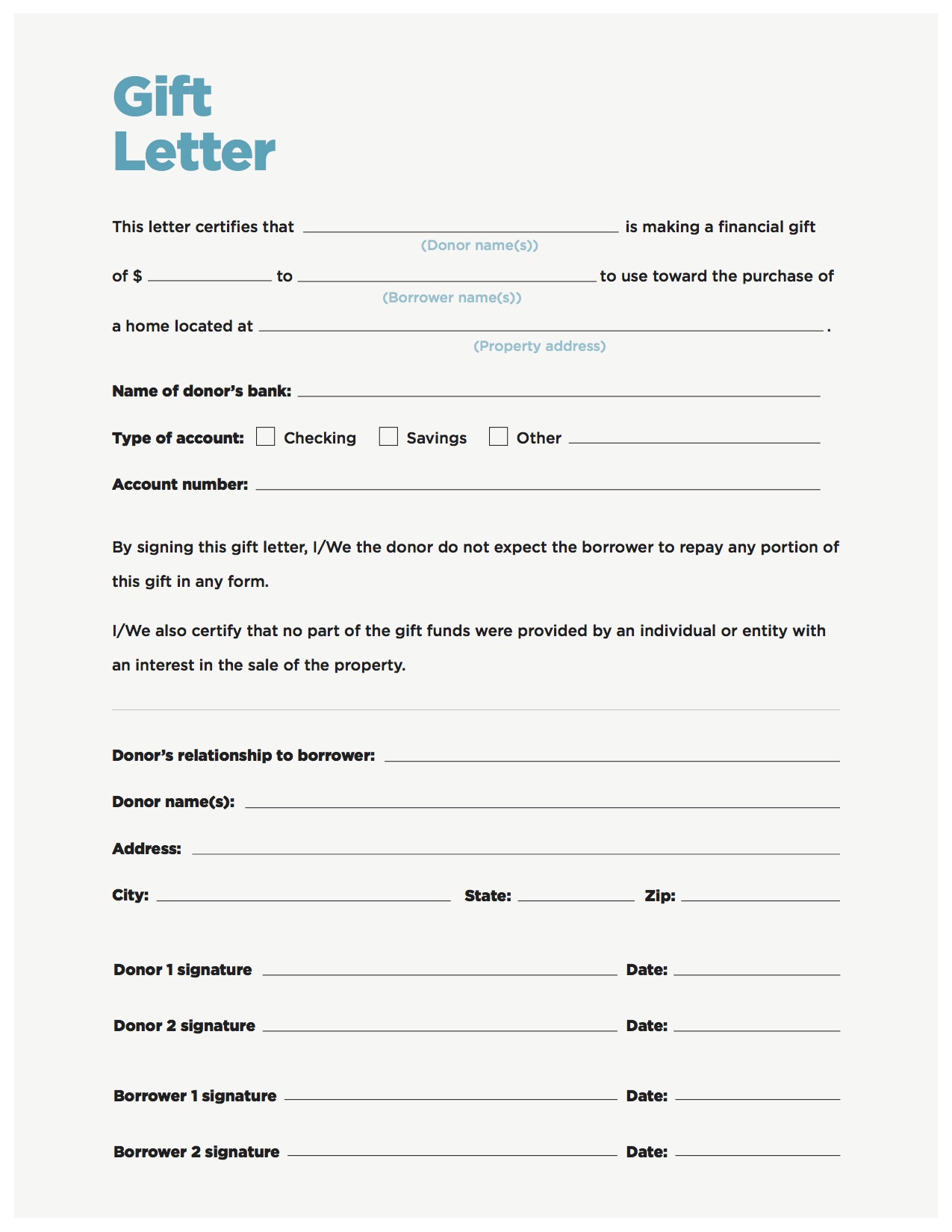

NECESSARY DOCUMENTATION FOR ALL LOANS (FANNIE MAE, FREDDIE MAC, FHA, USDA, VA) 1 Verification that gift funds were deposited into applicant's bank account (bank statement) or attorney trust account (escrow letter) 2 Donor's bank statement evidencing funds came from donor's accountCHFA performs program compliance review Borrowers are required to have a minimum contribution of $1,000 either from their own funds or gift funds Gift Funds must be acceptable to the insurer/guarantor of the loanMay 13th, 19 For Fannie Mae and Freddie Mac gift funds are accepted in their entirety on single family residences The split between what amount can be gifted and what is your own contribution to the down payment depends on the loan type A gift letter states that the money you were gifted is indeed a gift and not a loan meaning you don't have to 13 Sample Gift Letters –

Gift Money Can Meet Your Down Payment Needs Nerdwallet

Using Gift Funds For A Down Payment To Buy A House

Freddie Mac will also require a signed gift letter showing no repayment needed Below is a snipit from One of the most common sources for gift funds are family members Overview of Fannie Mae Gift Guidelines Along with Freddie Mac, Fannie Mae is one of the two governmentsponsored enterprises that buy loans from lenders These two corporations have specific guidelines and requirements for the kinds of mortgage loans they can purchase And these requirements Down payment gift from family $5,000;

Using Gift Funds For A Down Payment To Buy A House

Freddie Mac May Need Another Taxpayer Bailout This Week Marketwatch

• Gift funds are allowed in accordance with Freddie Mac guidelines • The following requirements apply when evaluating deposits on the Borrower's account statements o Except as stated below, the Correspondent is not required to document the sources of unverified deposits for purchaseIn addition to their own funds, a borrower can also receive assistance in reaching the minimum three percent contribution on a oneunit property from other sources These include a gift from a person meeting the Guide definition of a related person, funds from a governmental or nongovernmental agency, Employer Assisted Homeownership (EAH) programs, and Affordable– Borrower contribution, including gift funds – Reserves – Other criteria Apply the following MGIC Go!

The Seller Servicer Guide Freddie Mac Single Family

New Content Mortgageinsurance Genworth Com Documents Training Course Acceptableusegiftfunds Presentation 10 Pdf

Freddie Mac Verifying Gift Funds Customer Education Use of Gift Funds 12 Asset eligibility and documentation requirements EffectiveFreddie Mac SingleFamily Seller/Servicer Guide (Guide) CREDIT AND LIABILITIES Topic Streamlined Accept Documentation Standard Documentation Completing Liabilities Section of the Loan Application (Guide Section 378 and 3716) the Borrower if any additional tradeline refer Review the Mortgage application, credit report, borrower's paystubs (if provided) and other fileFreddie Mac BorrowSmart Assistance amount $1,500;

Using Gift Funds For Your Home Down Payment Divorce Mortgage Advisors

The Capital Note Fannie Mae Freddie Mac And John Mcafee National Review

A gift or grant from the Seller as the originating lender, provided that a contribution of at least 3% of value (as described in Section 431) is made from Borrower personal funds and/or other eligible sources of funds as described in this section The gift or grant must not be funded through the Mortgage transaction, including differential pricing in rate, discount points, or fees for Freddie Mac gift guidelines Similar to Fannie Mae, Freddie Mac provides funding for conventional loans Under Freddie Mac guidelines, your entire down payment can be gifted by a relative if you're buying a singlefamily home as your primary residence However, unlike Fannie Mae, you don't need to meet any minimum borrower contribution if you're getting a gift of % Gift Funds A borrower of a mortgage loan secured by a principal residence or second home may use funds received as a personal gift from an acceptable donor Gift funds may fund all or part of the down payment, closing costs, or financial reserves subject to the minimum borrower contribution requirements below Gifts are not allowed on an investment property

Mortgage Down Payment Sources Down Payment Options Guaranteed Rate

The Ins And Outs Of Giving Or Receiving Down Payment Gifts Elite Realty Brokerage

Related Question Freddie Mac – Gift Donor Funds Can a gift donor use funds from their trust account if they are the sole trustee and beneficiary?I heard you cannot Does this rule vary by lender, state, or is it federal Have a client that was hoping to use funds from a parent for this, up to the $14,000 max Fannie Mae and Freddie Mac do not allow gift funds on investment homesFreddie Mac Gift Letter Form freddie mac prohibits seller gifts and grants as eligible, ellie gift mae letter mapfretepeyac com, fnma guidelines fnma program guidelines v bancorp, forms resources royal pacific funding, can gift money for a down payment come from a business, using gift funds for a down payment atlantic bay mortgage, free real estate gift letter forms printable

Guide To Down Payment Gifts Seattle Mortgage Planners

2

Round up gifts from family or grants or loans from different sources, including personal funds, gift funds, grants and affordable second mortgagesIn fact, last year nearly a third of the 16 million loans that Freddie Mac funded were qualified borrowers can get a mortgage Myth 1 I need a % down payment as little as Freddie Mac's Home Possible Advantage mortgage, require a downFreddie Mac Home Possible® Mortgages A responsible, low down payment mortgage option for firsttime homebuyers and low and moderate income borrowers Freddie Mac Home Possible® and Home Possible Advantage® mortgages (collectively referred to as Home Possible mortgages) offer outstanding flexibility and options to meet a variety ofMortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) and is not intended to replace Fannie Mae or Freddie Mac Guidelines The guidelines are designed to establish and implement sound underwriting criteria, as well as to serve as a reference tool in tandem with the product descriptions

What Is A Gift Letter For Your Mortgage

New Content Mortgageinsurance Genworth Com Documents Training Course Acceptableusegiftfunds Presentation 10 Pdf

Freddie Mac Form 65 • Fannie Mae Form 1003 URLA Effective 9/ • Instructions Revised 3/ Instructions for Completing the Uniform Residential Loan Application Uniform Residential Loan Application The Uniform Residential Loan Application (URLA) contains the following sections Section 1 Borrower Information Collects your personal information, income and employmentFor a second home with a loan to value above 80%, the borrower must once again provide at least 5% of their own funds; Freddie Mac does allow the use of the gift of equity home purchase They do require a gift letter to be signed by all parties The letter must provide the donor's name and the amount being given to the related person (buyer) The gift letter must include the

What Are The Gift Limits On A Home Loan House Team

All About Gift Funds Frank Rexford

Does anyone know the rules about using gift funds for investing in property?This brief, 15minute course will review both Fannie Mae & Freddie Mac's guidelines on the allowable use and documentation of gift funds in a mortgage loan transaction Learning Objectives Understand which types of transactions allow gift funds to be used Learn how to properly document gift funds and enter them on the URLAAfter 5%, get funds are allowed;

Gift Funds For Home Purchase Mortgage Lending Guidelines

Rules To Use A Gift As A Down Payment For A House

Freddie Mac mortgages require at least 5% from the borrower when the loan is secured by a second home and the LTV is greater than 80% A clear explanation that the money is a gift, not a loan (borrowed funds are not allowed for downpayment gifts) The downpayment gift letter should be signed by you and the person or entity making the gift It should also beThese Freddie Mac mortgage options can help lenders originate 1 to 4unit investment property mortgages to enhance origination strategies and customize mortgages to borrower's individual needs and financial strategies

Genworth Financial Slides For Understanding Freddie Mac S Loan Prosp

Financing Residential Real Estate Lesson 10 Conventional Financing Ppt Download

Www Chfainfo Com Participating Lenders Single Family Freddiemacjuly19 Lpa Guide July 19 Pdf

Can I Use A Gift For Down Payment Wynn Eagan Team At Citywide Home Loans

What Is A Gift Letter And How Do You Use It Quicken Loans

Your Guide To Using Gift Funds For A Down Payment

Your Guide To Home Possible Mortgage Freddie Mac Single Family

1

Fillable Gift Letter Template Printable Pdf Download

New Content Mortgageinsurance Genworth Com Documents Training Course Avoidingcommonuwerrors Presentation 0919 Pdf

Using Gift Funds For Down Payment What To Know

Gift Funds By Family Members Mortgage Guidelines

Here Is Why Fannie Mae And Freddie Mac Loans Matter To You

Http Www Freddiemac Com Singlefamily Factsheets Sell Pdf Home Possible 97 572 Pdf

Fannie Mae Vs Freddie Mac The Difference Rocket Mortgage

Using Gift Funds To Buy A Home My Mortgage Guy Dan

Q Tbn And9gcs3enp2oea9ljhqdg5tg0143xdw7x Twhjbhvkuy5s Usqp Cau

Fannie Mae Freddie Mac Shareholders Could Benefit From The Trump Administration S Proposed Budget Marketwatch

Freddie Mac S Home Possible Versus Fannie Mae S Homeready Which Is Better Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mmp Maryland Gov Lenders Documents jobaidhfaadvantageloanproductadvisor Pdf

Carl Icahn Buys 51 Million In Fannie Mae Freddie Mac Shares The Washington Post

Using Gift Funds For A Down Payment To Buy A House

2

How To Use Gift Money For A Down Payment On A Home

Using Gift Funds

What Is A Gift Letter For A Mortgage The Truth About Mortgage

How To Write A Gift Letter For A Mortgage Clever Girl Finance

Gift Money For Down Payment And Gift Letter Form Download

Fannie Mae Gift Letter Fill Online Printable Fillable Blank Pdffiller

Mmp Maryland Gov Lenders Documents jobaidhfaadvantageloanproductadvisor Pdf

Ask An Ru Borrower Minimum Contribution Basics Enact Mi Blog

Gift Letter Template Fill Out And Sign Printable Pdf Template Signnow

New Content Mortgageinsurance Genworth Com Documents Training Course Avoidingcommonuwerrors Presentation 0919 Pdf

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage We Ve Dropped Our Minimum Fico Score To 6 For Kentucky Mortgage Loan Approvals

Guide Bulletin 36

Is A Down Payment Gift Allowed First Lenders

Www Findmywayhome Com Wp Content Uploads 17 08 Freddie Gift Funds Pdf

Fannie Mae Gift Funds Using Gifted Funds Toward Your Home Purchase

What To Know Before Using Gift Funds For Down Payment Mybanktracker

1

Should I Get A Gift Or Co Signer

Gift Letter Template Download Fillable Pdf Templateroller

Fannie Mae Guideline Changes Gifts 97 Financing And Mortgage Insurance Iloan Home Mortgage

2

1

/rules-for-documenting-mortgage-down-payment-gifts-4157907-FINAL-9c59d5c0b3e445e1a142b323f35176e1.png)

How To Document Mortgage Down Payment Gifts

Mortgage Down Payment Sources Down Payment Options Guaranteed Rate

/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

How To Get Pre Approved For A Mortgage

The Hudson Mortgage Group

Freddie Mac Home Possible Mortgage Product Requirements 3 Open Mortgage

Fannie Mae Afrwholesale Com

Gift Letter Template Fill Out And Sign Printable Pdf Template Signnow

Documenting Gift Funds To Close On Your First Home

Fannie Mae Vs Freddie Mac Primacy Real Estate

How To Use Gift Money For Your Down Payment Quicken Loans

2

Fannie Mae Vs Freddie Mac Primacy Real Estate

What Is A Gift Letter For A Mortgage The Truth About Mortgage

Sf Freddiemac Com Content Assets Resources Pdf Update Docmatrix Pdf

Freddie Mac Home Possible Mortgage Fact Sheet Freddie Mac Single Family

Gift Money Can Meet Your Down Payment Needs Nerdwallet

Guaranteed To Fail Fannie Mae Freddie Mac And The Debacle Of Mortgage Finance Acharya Viral V Richardson Matthew Van Nieuwerburgh Stijn White Lawrence J Amazon Com Books

Freddie Mac Announces Credit Underwriting Changes Cla Cliftonlarsonallen

Fannie Mae Guideline Changes Gifts 97 Financing And Mortgage Insurance Iloan Home Mortgage

You Can Get A Gift From A Relative To Cover Your Fha Down Payment Those Funds Can Also Cover Your Closing Costs And Reserves Clic Real Estate Advice Fha Fund

Freddie Mac Relief Refinance Open Access Program Guide Fixed Rate Pdf Free Download

Maria Fedachtchin Mortgage Loan Originator Home Facebook

Gift Funds By Family Members Mortgage Guidelines

Fillable Freddie Mac Form 1132 Authorization For Automatic Transfer Of Funds Through The Automated Clearing House Ach Printable Pdf Download

Home Possible Loans Beginner S Guidelines Rocket Mortgage

Conventional Loans Fannie Mae And Freddie Mac Realty 101 Blog

Gift Of Equity Home Purchase By Family Members

コメント

コメントを投稿